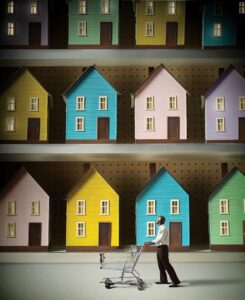

Think single-family rental homes are just for small-scale investors? Not anymore. Things are changing, and today there’s enough interest from large-scale and midsize investors alike to fully cement single-family rentals (SFR) as a viable asset class in and of itself.

Most institutional-level investors first began showing interest in SFR immediately following the housing market crash of 2008 when they began buying up foreclosed properties. Recent advances in technology, increasing transparency and the removal of operational difficulties have all given rise to the ability to not only invest in, but also manage properties from afar. All of these factors have combined to help establish SFR as a large-scale, fully-fledged asset class.

Today, we in the SFR industry are seeing all of these changes contributing to what I refer to as the rise of the midsize investor, or an investor who owns between 25 and 2000 homes.

Why so much interest in SFR?

It’s one investment that offers a number of distinct advantages — particularly cash flow and long-term appreciation. It’s also a great alternative investment. One analysis found that, historically, returns from SFRs have moved independently from the stock market, making it a great way to diversify funds.

Currently, single-family and two- to four-unit residences comprise more than 53% of U.S. rentals, representing about 23 million units. Additionally, an estimated 13 million new rental households are expected to form by 2030. Housing stock isn’t projected to keep up with this demand, meaning there’s great potential for investors who own income properties.

To put it another way, 35% of renters across the U.S. are in SFRs. Demand for rentals is expected to continue growing for the foreseeable future.

The Midsize Investor

During the Great Recession nearly a decade ago, investors began funneling money into the housing market, buying up and refurbishing millions of foreclosed homes. While many people thought they’d hold onto them until property prices had recovered and then sell and make a tidy profit, many of the homes have since been turned into lucrative rental properties.

Still, while institutional-level interest in SFR has grown as a whole in recent years, large-scale investors still account for a small percentage of total SFR investment activity. According to one analysis, these investors own less than 2% of all SFR investment properties and are active in less than 30 metro areas across the nation. Meanwhile, almost 90% of SFR inventory is owned by small-scale investors with fewer than 10 units. There appears to be a lot of room in the market for investors of any size to invest.

Today’s midsize investor buys a few properties at a time and manages them remotely. The advantage of this method is that it allows them to take a more nimble approach, trialing different housing markets to see how they’ll perform. It also allows them to diversify, investing in different markets to spread the risk.

Additionally, as housing prices continue to grow, the advantages of diversifying by investing in different housing markets become even more clear. A few years ago, investors were searching for properties primarily in the top 10 or 15 housing markets across the U.S. Today, those same investors can expand their search to include secondary markets and will be looking in the top 100 markets. Not only are these markets more affordable; they often offer better returns as well.

An Investor-Friendly Environment

Another factor contributing to the growth of SFR on a larger scale is that many operational difficulties have been removed. Property management services today are changing to accommodate the needs of large-scale investors, with investor-friendly property managers able to provide services at scale. No longer do they max out at 20 or 30 properties; instead, many have the resources to oversee hundreds, if not thousands, of properties. This frees up investors to purchase properties that are out of state, and it allows them to invest in more units than they could manage if they were overseeing everything on their own.

Investors today also have options when it comes to acquisition and disposition of properties. The advent of investor marketplaces means that houses no longer need to be vacant in order to be sold to owner-occupiers. Instead, there’s a whole new market of investors and landlords who are lining up to buy homes, complete with tenants. Turnkey real estate is growing, and fast. Today, there are portals where you can sell lots of 25-200 homes without removing the tenants first.

How To Identify Emerging Markets

For investors who are looking to get on board with SFR investments, I recommend the following steps to identify up-and-coming markets.

• Home price performance: If property appreciation is part of your investment strategy, you’ll want to ensure that you find a market where homes are increasing in value.

• Employment trends: Check the region's unemployment rate, and see what the main industry is. Watch out for areas that rely too heavily on any one industry.

• Population growth and expected growth: You’ll want to look for an increase that's projected to continue, but also consider why people are moving in. What’s drawing them to the region?

• Building permits: Check to see how many building permits are being pulled. If there are too many, you’ll want to make sure the area will be able to absorb the supply.

• Affordability: Can your tenants afford the rent? If the median income is more than 66% of the median annual rent, that's a sign of an affordable market.

• Absorption rates: How quickly are new buildings being rented? What’s the absorption rate? This will help you to gauge whether an area is experiencing rental demand.

Thanks to institutional-level investor interest and continued development in the space, SFR has claimed its place as a solid asset class. It will be interesting to see its ongoing development as demand from investors and consumers alike continues to grow.

Source: Noel Christopher (Forbes)

Photo/s credit to the owners

Follow us:

IG: southcrestrealty

Twitter: southcrest2012

Facebook: SouthCrest Realty